Overview

When it comes to cryptocurrency exchanges and investing in them, users located outside the US generally prefer choosing platforms that are local to their own country. This has a variety of advantages associated with it.

For starters, it means that users can very easily deposit and withdraw funds from their accounts in their local currency. It also has the added advantage of ensuring that the exchange is regulated and reliable. However, such local exchanges are far and few between, and it is usually difficult to find such exchanges.

CoinSpot is one such exchange that is designed specifically for users in Australia. In this CoinSpot review, we analyze the exchange and identify what kind of traders it is most suitable for.

What is CoinSpot?

CoinSpot is an Australian cryptocurrency exchange that is headquartered in the city of Melbourne. It was founded in the year 2o13 by Russell Wilson and has since grown to become one of the largest crypto exchanges in the country of Australia.

The platform is a safe and reliable means for Australian users to buy and sell a large variety of cryptocurrencies.

The CoinSpot exchange is also regulated by the Australian Digital Commerce Association (ADCA), which is known for providing legal protection to the clients that use regulated exchanges. Therefore, this ensures that CoinSpot provides a safe platform through which users can buy cryptocurrencies without having to worry about whether or not their funds are secure.

There are 3 main kinds of customers that can invest and trade through the CoinSpot platform – individuals, companies, as well as Super Fund investors. The platform offers them the ability to instantly buy or sell cryptocurrencies like Bitcoin and others.

CoinSpot Review – Pros

The CoinSpot trading platform has several pros associated with it, which include:

Large Variety of Cryptocurrencies

The CoinSpot exchange is one of the largest and most popular in Australia, and this is largely attributable to the sheer number of cryptocurrencies that they support and provide access to.

Through CoinSpot, users can trade over 200 cryptocurrencies, which includes all the major coins as well as some exotic cryptocurrencies too.

This number isn’t fixed and keeps growing from time to time as CoinSpot keeps adding newer and more popular coins to its platform.

Low Fees

For active traders, the fees they pay as a part of trading on any platform become a major part of their profitability calculations. Therefore, they are constantly on the lookout for platforms that can allow them to trade with lower fees.

CoinSpot is one such platform, and it is known for having among the lowest fees in the Australian blockchain space. As we shall see in the Fees section of this review, the fees associated with CoinSpot are among the lowest in the industry.

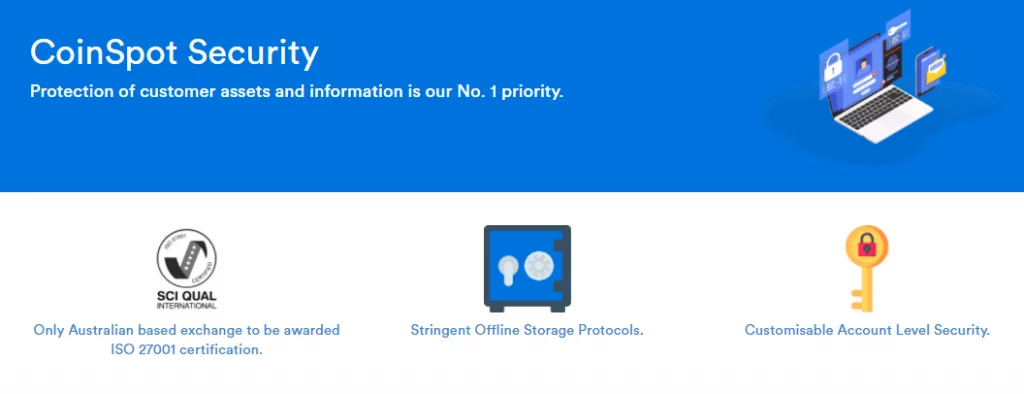

Strong Security System

While we discuss this more in the security section of this review, it is important to note that CoinSpot is among the most secure cryptocurrency exchanges in the world, and this has been proven time and time again as the platform has been a victim of an attempted cyberattack.

There are a variety of security features that the platform uses in order to protect its users, their funds, and their data. Given the high trading volume on the platform, it is no surprise that CoinSpot is the victim of several cyberattacks, however, the platform’s security features are industry-grade.

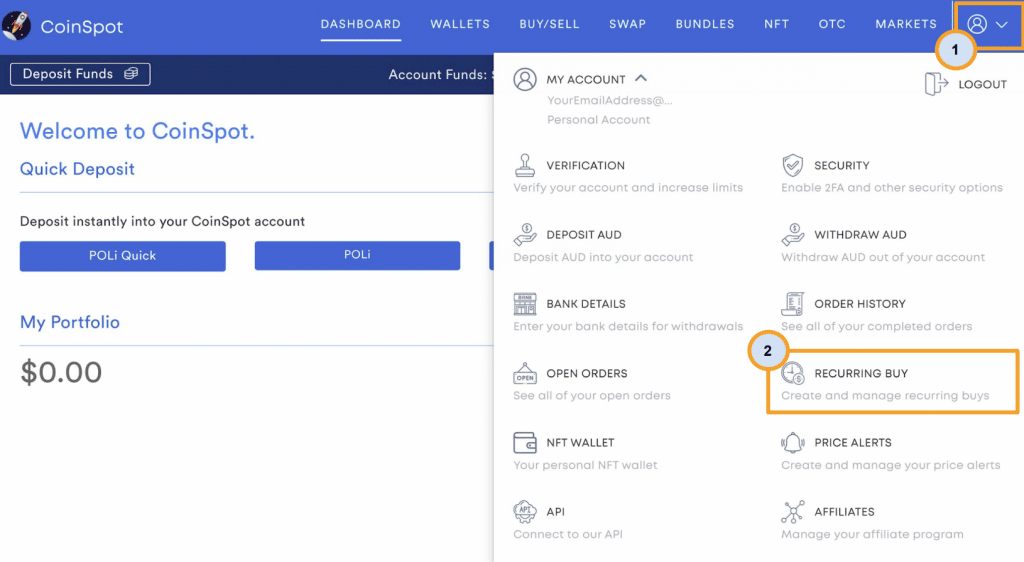

Schedule Automatic Purchases

Another new feature that CoinSpot has added in order to expand its suite of offerings is that of allowing users to make automatic recurring purchases of a particular cryptocurrency.

For example, suppose you wish to invest a fixed % of your paycheck into Bitcoin every month. With CoinSpot’s new recurring investment feature, you can do so automatically, by selecting a fixed investment amount and setting the frequency to monthly.

Once you do this, every month, CoinSpot will deposit the fixed amount into your CoinSpot account and invest it into Bitcoin automatically. This is a good feature for those who are long-term investors and wish to Dollar-Cost Average their investments over long periods of time.

Instant Purchases

Another advantage that the CoinSpot platform offers is the ability to easily and instantly purchase cryptocurrencies through the use of your credit or debit cards.

Once you have verified your account and begin trading, you can then decide to buy any cryptocurrency you want almost instantaneously.

The process of instantly buying a cryptocurrency is as simple as heading over to the Marketplace, selecting the cryptocurrency you wish to purchase, entering the quantity, choosing what credit or debit card you wish to use and clicking on buy.

Highly Regulated

As we mentioned earlier, one of the biggest advantages associated with using the CoinSpot platform is the fact that it is highly regulated by the Australian authorities.

For example, we have already discussed how CoinSpot is a member of the Australian Digital Commerce Association, which gives its customers an added degree of protection.

Additionally, the platform is also certified by the ISO for quality and is licensed by the AUSTRAC, giving investors confidence that their funds are being parked on a safe platform.

Easy to Navigate Platform

Unlike other trading platforms and exchanges that are usually designed to maximize the number of features provided, CoinSpot chooses to focus on simplicity. Their platform has been designed in a way that is easy to navigate and quite intuitive, which adds to the customer appeal.

Additionally, even though the trading platform has a fair number of features and options for advanced traders, the focus is on simplifying the process as much as possible, so the default setting on the platform is to provide the simplest settings and then allow users to customize the interface based on their preferences.

The simple design of the app ensures that newer investors or traders will not be dissuaded or intimidated by the sheer number of features that are present to them, and they can make the journey to becoming experienced investors at their own pace.

Strong Customer Support Team

One of the more common concerns among users that regularly trade through cryptocurrency exchanges is the fact that most of these exchanges do not have good customer service teams, which makes it very difficult to get queries resolved or issues sorted out.

This is where the CoinSpot exchange stands out, as it provides users with a 24/7 Live Chat support team, which can resolve most basic queries and create a more convenient trading experience for traders.

CoinSpot Review – Cons

Every coin has two sides, and the CoinSpot trading platform is no exception. There are several cons associated with the platform, which include:

Only Accepts AUD

Another disadvantage associated with the platform is that it only accepts Australian Dollars (AUD) for deposits and withdrawals.

While this is a highly suitable feature for most traders and investors located in Australia, it can be a problem for those located in Australia who work online and receive their payments in a variety of other currencies.

Additionally, this can also be an issue for those who wish to deposit their funds into CoinSpot using a different currency, as they will have to pay a currency conversion fee, which can often be a time-consuming and expensive process.

Trading Restrictions for New Users

Another problem that users of the platform have is the fact that it imposes several trading restrictions on new users, thereby making it harder for them to freely and effectively trade in the immediate aftermath of setting up their trading account with CoinSpot.

For example, initially, in the first week after setting up an account on the platform, there is a limit on how much trading volume the user can have. This volume cap is then gradually increased over the next few weeks as the platform observes the trading behavior of the user and makes assessments.

While this is a necessary regulatory requirement that requires the exchange to make sure that advanced traders understand the risks that they are facing, several investors and traders through the platform have reported that they feel like the whole process is a hassle.

Does Not Support Shorting

There are two kinds of transactions that traders normally make on cryptocurrency exchanges: going long and going short. While the former is usually done when traders expect the prices of the asset to go up, shorting is done when traders are bearish on an asset and expect the prices to fall.

Unlike other exchanges, CoinSpot does not allow users to short crypto assets through the platform. This is very inconvenient as a variety of trading strategies involve going short on assets, and the absence of this feature reduces CoinSpot’s appeal as an advanced trading platform.

No Margin Trading

Another very crucial feature that is missing from the platform is the ability to trade on margin. This is an extremely important feature for any platform, especially one that wishes to appeal to more experienced investors.

Margin trading is the ability to borrow funds from the exchange and open positions, thereby giving traders the ability to open positions for higher amounts than their capital investment. For example, if a trader opens a position with AU$1,000 of their own capital on a 10% margin, then they will effectively borrow AU$9,000 from the exchange and open a combined position of AU$10,000.

Therefore, since larger positions are being opened, this will magnify the profits (or the losses) faced by the trader. Margin trading is very popular among experienced traders, and the fact that it is not present on CoinSpot is a major issue with the platform.

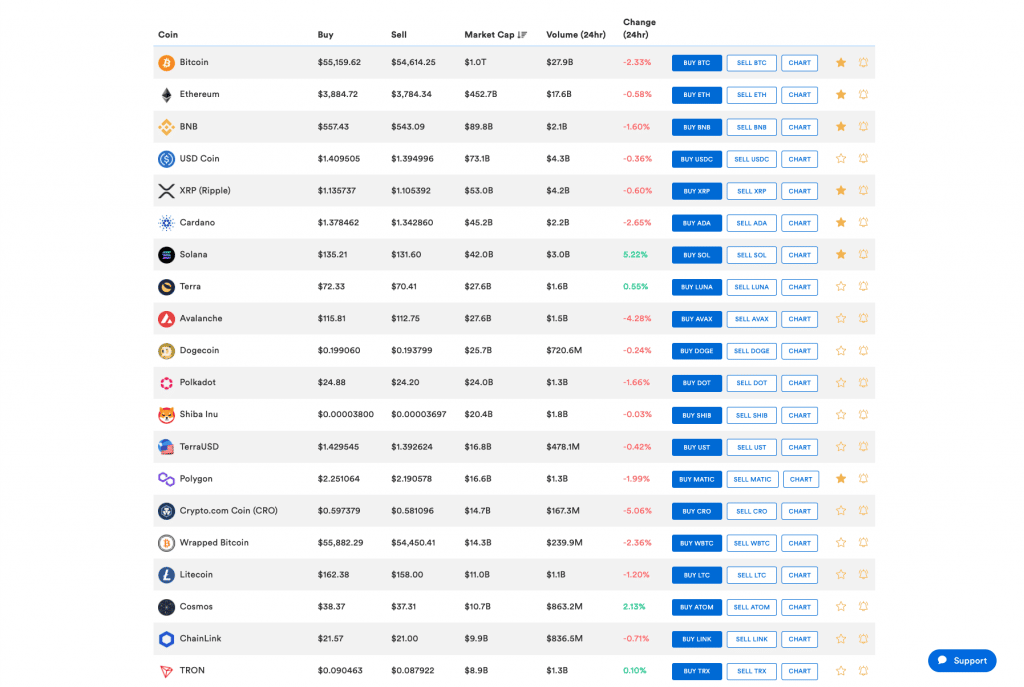

CoinSpot Review – Cryptocurrencies Supported

Initially, when CoinSpot started out as a cryptocurrency exchange, it only offered support for Bitcoin. Since then, however, the platform has evolved to support over 200 cryptocurrencies, which includes all the major coins as well as a few exotic cryptocurrencies too.

Some of the major coins that are supported by the platform include:

- Bitcoin

- Ethereum

- Litecoin

- Ripple

- EOS

- Stellar

- NEO

- Tron

- Bitcoin Cash

In addition to these cryptocurrencies, the CoinSpot app also accepts a variety of other DeFi tokens and coins including the AAVE token, the Uniswap token, and the COMPOUND token.

CoinSpot Review – Fees

Any trading platform charges two types of fees: trading fees and non-trading fees.

CoinSpot Trading Fee

Trading fees refer to the fees that users pay in order to place orders on the platform and have them executed. Most cryptocurrency exchanges charge trading fees in one of two ways: they either charge spreads or commissions.

Spreads

Spreads refer to the difference between the bid price and the ask price. This model is primarily adopted by market-maker trading platforms that assume the position of the counterparty in the trade. Therefore, you are effectively trading against the platform.

When this happens, there is usually a difference between the price at which you can buy the asset and the price at which the asset can be sold at any given moment. The buying price, also called the bid price, is almost always higher, and the difference between these two prices is called a spread.

What this effectively means is that if you were to buy and sell an asset at the same time, you would actually incur a loss.

Commissions

The other form of trading fee that might be charged by an exchange is a flat commission on every trade that you make. This is usually a very small percentage of the trading volume and is done in a decreasing manner, i.e. the higher your trading volume, the lower the fees that you will have to pay in this regard.

CoinSpot Fee Structure

The fee structure employed by CoinSpot is a flat commission-based structure.

All the trades that are placed on the platform for buying, selling, or exchanging cryptocurrencies are charged a flat fee of 1%.

Similarly, a flat fee of 1% per trade is also levied on special types of orders such as stop-loss orders, take-profit orders, as well recurring buy orders.

Unlike most other exchanges, CoinSpot does not charge fees based on a maker-taker structure, and all kinds of trades are charged with a flat 1% trade.

On the other hand, if traders choose to use the platform’s OTC feature, then the fee that they are charged on this trade is just 0.1%.

CoinSpot Non-Trading Fee

In addition to the trading fee, cryptocurrency platforms often also charge a variety of other incidental fees and charges. These have been discussed in detail below.

Deposit Fees

Most cryptocurrency exchanges charge fees in order to allow users to deposit money into their accounts.

On CoinSpot, there are no charges associated with depositing funds to your CoinSpot account, whether you choose to do so in the form of fiat currency or cryptocurrencies. The only fees that you will end up paying are the network fees associated with the deposit.

If users choose to deposit funds through fiat currency or cash, there is a specific fee charged; the exchange charges a fee @2.5% (for cash deposits) or 0.9% (for BPAY deposits), which are actually the transaction processing fees and surcharge charged by traditional banks.

Withdrawal Fees

Similar to deposit fees, most cryptocurrency exchanges also charge fees if you wish to withdraw money out of the platform. When you wish to withdraw money from your CoinSpot account, there are no withdrawal charges associated with it in case you choose to withdraw the funds to your bank account directly.

On the other hand, when you choose to withdraw funds into another crypto wallet, you might be charged a gas fee based on the coin and network you choose to withdraw to.

CoinSpot Review – Platform Features

There are several features associated with the CoinSpot ecosystem that make it such a strong exchange in the Australian cryptocurrency exchange industry. These have been discussed below in detail.

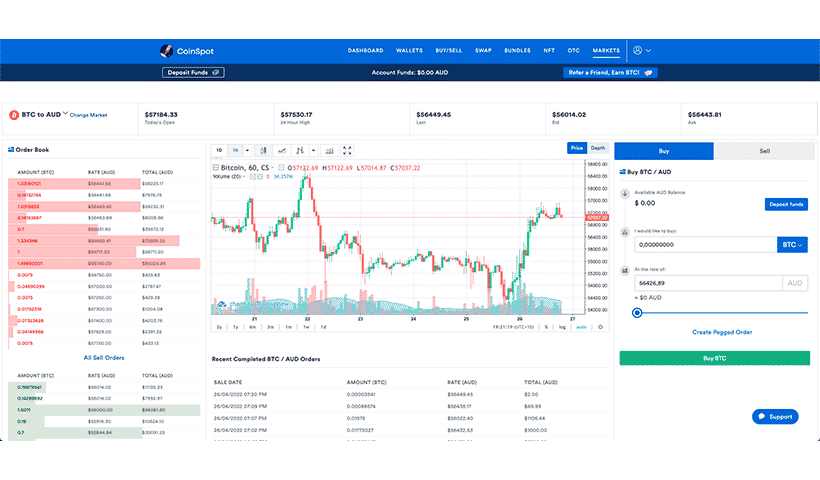

Instant Trading

As we discussed earlier, CoinSpot allows users to instantly purchase and sell cryptocurrencies without having to go through a lengthy process.

Once you have verified your account and added a payment method, then you can easily choose to buy any cryptocurrency you want without having to negotiate the price through an order book.

Additionally, the price charts that the platform offers are quite advanced and contain a lot of charting and analysis tools which make it easier for traders to make more informed decisions.

Affiliate Program

CoinSpot’s fee structure is primarily centered around a commission-based model, which means that they earn more money if a greater volume of transactions is conducted through the platform.

Essentially, this means that it is in the platform’s best interest to ensure that as many people as possible come to the platform and begin trading through it. Therefore, it launched an affiliate program that is used to encourage people to bring in new users to the platform.

Through the affiliate program, users can have their own referral IDs, and for every new user they bring in through their referral ID, they can earn money and also get rebates on fees.

Therefore, users can earn commissions on the trading fees of their referrals, and at the same time see a decline in their own trading fees through the affiliate referral program.

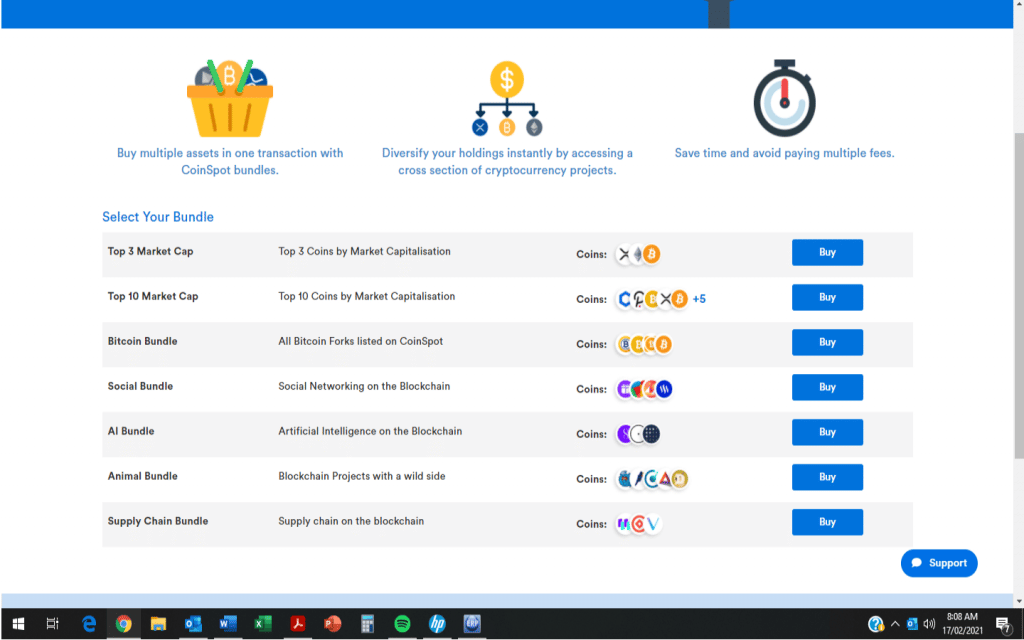

CoinSpot bundles

CoinSpot also offers users access to bundles that they can use to instantly diversify their investments.

For example, if a trader wishes to increase the diversification in their portfolio, they do not have to go and manually purchase a variety of assets to do so, instead, they could simply opt for buying one of the pre-made CoinSpot bundles, and use this to diversify their investments.

Some of the bundles that are available on the platform range from sorting coins through their market capitalization, ESG score, as well as through the sector they are linked to: NFTs or DeFi.

Multi-coin wallet

Whenever you make a trade through the CoinSpot platform, your assets are then stored on the internal wallet that CoinSpot offers.

This is a multi-asset wallet that can store over 300 different cryptocurrencies. Additionally, this wallet also gives you the ability to transfer cryptocurrencies to and from other third-party wallets such as Metamask.

Earning on CoinSpot

Most traders do not trade cryptocurrencies all the time, and a lot of them can choose to hold on to their assets during a bearish phase in the market.

In situations like this, it is always better to be trading through an exchange that will allow you to earn interest on your idle crypto assets, such as CoinSpot.

Through the CoinSpot staking opportunities, users can stake their cryptocurrencies and then earn rewards on them based on the coin and the duration for which they have staked the asset.

However, the staking feature is only available for a limited number of coins, such as DOT, AVAX, and MATIC.

NFT marketplace

CoinSpot also has an NFT marketplace that is specifically designed to make the process of buying and selling NFTS as convenient as possible for users based in Australia.

While the NFT collections that are offered through this marketplace are somewhat limited, they do include some of the more popular collections such as the Bored Ape Yacht Club.

NFTs are usually priced in ETH tokens because most of them have been developed on the Ethereum blockchain, however, you can use any wallet or token you wish to purchase and trade NFTs.

SMSF support

CoinSpot also offers support for users who might wish to add cryptocurrencies to SUper FUnds that are being managed by them.

For this purpose, the team at CoinSpot includes a range of Self-Managed Super Fund (SMSF) experts who can help advise users who own SMSFs or are interested in starting one.

Because the process associated with setting up an SMSF can be quite complicated, the team at CoinSpot is present to ensure that interested customers can do so easily without any difficulties.

OTC trading

CoinSpot customers can also access their OTC offering if they wish to make large trades worth more than $50,000.

The OTC desk managed by CoinSpot offers traders with a direct channel through which they can buy and sell their cryptocurrencies without having to list the order on an exchange.

CoinSpot Review – Safety Measures

For users who are just getting started with cryptocurrencies, and even for more experienced users, security can be a major concern when deciding on an exchange that they wish to use in order to trade.

CoinSpot offers a robust industry-grade security infrastructure that can put potential investors at ease about the security of their funds and their data on the platform. To date, the CoinSpot has never been hacked, which is in some ways a testament to the efficacy of its security systems.

CoinSpot is a certified member of Blockchain Australia, as well as a registered member of the ‘Australian Digital Commerce Association’. It is also registered with AUSTRAC, an Australia-based anti-money laundering and counter-terrorism regulator, which adds a further degree of safety to the platform.

Additionally, as we discussed earlier, CoinSpot is also among the only exchanges in Australia that are accredited for its security by ISO.

To protect user funds against hacks or breaches, the platform also uses 2FA (two-factor authentication) which requires traders to enter a code generated on their registered mobile device to sign in to the CoinSpot platform or to withdraw their funds.

CoinSpot Review – Final Verdict

CoinSpot is one of the largest cryptocurrency exchanges in Australia, and as such, it is highly popular among Australians that wish to get involved with cryptocurrencies.

There are several advantages associated with trading through CoinSpot: for starters, it is highly regulated, offers a variety of payment methods, and also supports instant purchases through its platform, all at very low fees.

However, the platform has some downsides too, one of them being the lack of shorting and the absence of a maker-taker fee structure. Therefore, any user who is thinking of trading through CoinSpot should be well aware of the risks and downsides associated with the exchange before starting.

- Funds can be withdrawn 24 hours

- Large Variety of Cryptocurrencies

- Strong Security System

- Low Fees

- Instant Purchases

- Highly Regulated

You have the possibility to lose money when trading CFDs with this provider. Only invest what you can afford to lose.